AI and Automated Customer Service in the digital age

As technology is rapidly developing in the Industry 4.0, many banks with abundant resources pioneers investment in automated and multi-channel customer service. Two of the most popular AI solutions used in banks around the world are Chatbot and Voicebot.

In the banking sector, Conversational Banking seems to be the development trend of many customer services. It means that banks can automatically perform two-way interactions with customers via text (chatbot), or voice (voicebot). Chatbot and voicebot will be responsible for basic, manual, simple, repetitive and time-consuming tasks to help humans consultants reduce their workload and focus on more specialized tasks.

In Vietnam, the Technology Department of FPT Corporation has researched and developed many technology solutions to help improve the quality of customer service in many Vietnamese enterprises. Two solutions chosen by many large banks to build smart conversational banking are chatbot (FPT.AI Conversation) and FPT.AI Virtual Agent for Call Center, and both of them are based on FPT.AI Artificial Intelligence.

Chatbot – An effective consultant

Having millions of users across the country, every bank should have a chatbot since it is a productive employee. A chatbot can automatically serve thousands of users at the same time and millions of people each month, helping businesses streamline time-consuming tasks and quickly support customers without too many human resources.

Vietnamese banks often use Chatbot for 1 to 2 specific tasks or use it separately for each marketing campaign. For example, the National Citizen Bank (NCB) uses FPT.AI Chatbot as an effective employee for the campaign "Chat with Nira - Free data". Nira can provide customers detailed information and instructions to receive a free 4G data package. The whole process takes place without the involvement of humans. However, when consultants are needed, Nira will connect customers with them. In this way, chatbot Nira helps NCB save costs for personnel and bring an enjoyable experience to customers.

The Asian Banker has honored TPBank as the best digital bank since it applies many advanced technology solutions to the operational process, including chatbots. TPBank's chatbot T'Aio is set up to answer common requests from customers such as branch locations, consumer loan packages registration, etc. This information is provided fast, accurately by T'Aio and personalized for each customer.

In particular, the chatbot of FPT.AI also can perform many other tasks such as making consultation appointments, recording inquiries from customers, recording reviews, responding, filtering potential customers, and supporting to increase conversion in marketing campaigns, etc., thereby meeting the diverse needs of banks.

Virtual Agent for Call Center – A friendly agent

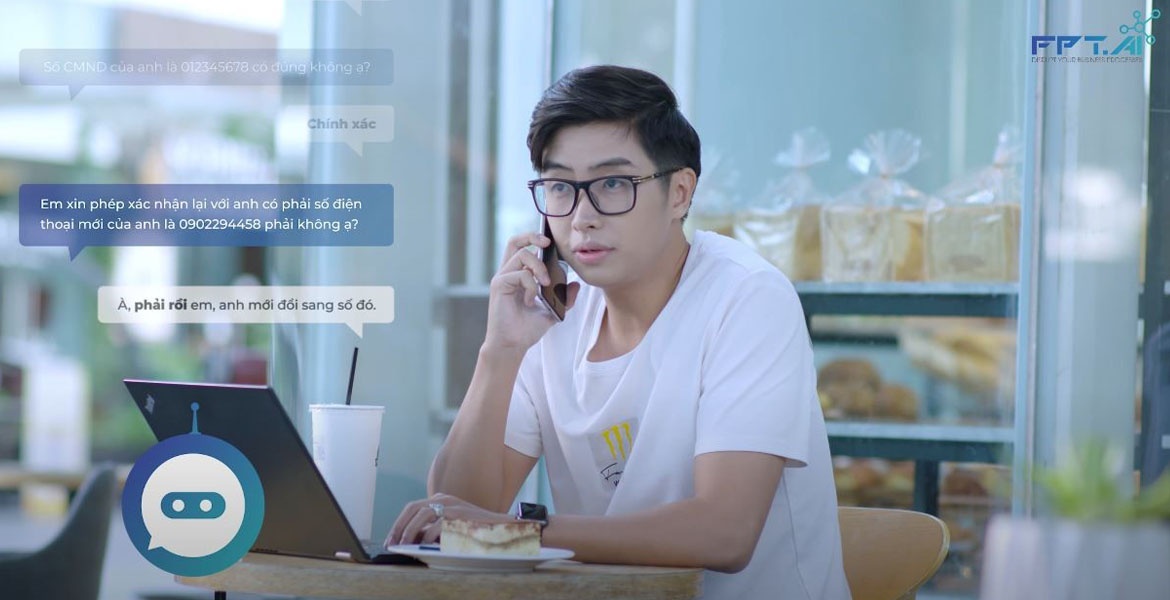

Virtual Agent for Call Center can convey the soft, natural communication like “humans” and has the fast, accurate automation of "machine", bringing a new combination to traditional call centers. Virtual Agent has all the advantages of Chatbot such as responding quickly following scripts in real time, working 24/7, reporting detailed statistics daily, serving thousands of users at the same time, etc. Also, Virtual Agent can have conversations with a natural voice and carry out two-way interaction with customers like humans.

In banks, Virtual Agent works as a Financial Assistant. When receiving inbound calls, Virtual Agent can handle tasks such as emergency locking cards, ending a service package, etc. Especially, Virtual Agent can automatically make thousands of outbound calls according to scripts. The purposes of these calls vary from reminding credit payment due date, conducting customer service surveys to providing information about product/service packages, promotions, etc.

Bulky call centers with hundreds of employees that costs billions of dong for facilities will be minimized when enterprises use Virtual Agent for Call Center of FPT.AI. It can be easily integrated into traditional call centers and can rapidly expand to serve thousands of customers/month.

In early 2020, the consumer finance company Home Credit successfully applied and launched the first Virtual Agent for Call Center in Vietnam. After 6 months of implementation, Virtual Agent for Call Center has made 300,000 calls per month, handled a huge amount of work that normally needs hundreds of agents to do in many months, helping Home Credit save 50% of operating cost. When the workload decreases, the efficiency increases, agents can focus on professional tasks to bring absolute satisfaction to customers.

Thanks to chatbot and voicebot, customers can interact with banks anytime, anywhere. It is the importance of advanced technology application in customer service, which is to help build strong relationships between banks and customers and to creat the competitive advantages in the future.

------------------------------------

? Experience #FPT_AI products at https://fpt.ai

☎ Hotline: 0911886353

? Email: [email protected]