Electronic Know Your Customer (eKYC) adoption at Vietnam's commercial banks

In 2021, electronic Know Your Customer solution (e-KYC) was implemented in many onboarding processes, marking an important milestone to digitalize the banking industry in Vietnam. Despite its new emergence, eKYC has proven its role to powerfully support commercial banks to enhance customer experience and optimize their activities. It can be said that electronic Know Your Customer is an inevitable trend of digital banks in 2022.

1. Reality and challenges in implementing eKYC in Vietnam's banking industry

More than a year since the State Bank of Vietnam allowed pilot eKYC implementation (July 2020), commercial banks in Vietnam received positive signs when the number of new customers and online transactions increased rapidly.

As a pioneer, Vietnam Prosperity Joint Stock Commercial Bank (VPBank) has succeeded in developing an eKYC solution with biometrics technology, eSignature, and artificial intelligence (AI). Subsequently, customers can open their accounts 100% online on VPBank's app in just 5 minutes. After 2 months of deployment, VPBank had around 15,000 new accounts. Besides VPBank, HD Bank and TP Bank also achieved impressive results when they accordingly received 15,000 and 30,000 requests to open new accounts online within the first month of eKYC activation.

Along with initial success, eKYC adoption in Vietnam faced certain challenges. Transactions made by accounts opened through eKYC have limits, especially the daily transaction limit.

As a result, security and deep fake forgery issues pose a big problem for tech companies when implementing eKYC in commercial banks.

2. Benefits and opportunities of eKYC for commercial banks

The above numbers partly reflect a strong disruption of eKYC in the finance-banking sector. So, how does eKYC technology help businesses gain competitive advantages? Let's review 2 main benefits of this solution with FPT.AI:

eKYC shortens verification processing time, enhances customer experience

When using traditional KYC, customers need to visit transaction offices to fill in forms and provide identity documents. This procedure is quite complicated and time-consuming, causing unnecessary problems for customers. In contrast, eKYC allows customers to perform these steps anytime, anywhere with a smartphone connected to the internet.

The emergence of eKYC makes opening an account and making transactions more convenient and safer in just a few minutes.

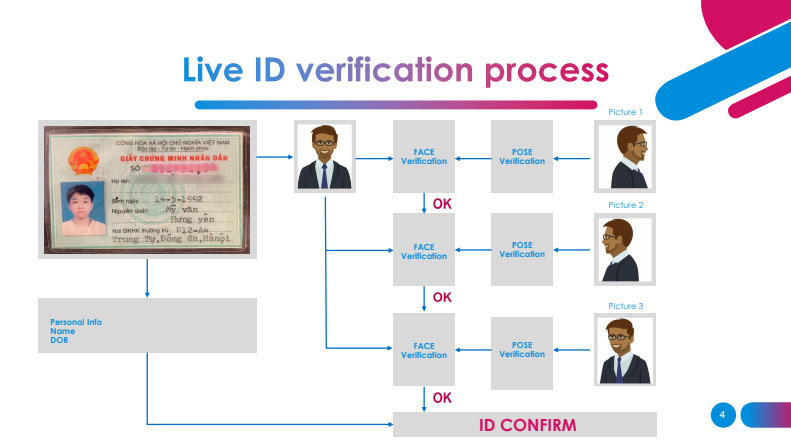

Today, most eKYC processes to open an account in banks have 3 steps:

Step 1: Verify documents: Take photos of identity documents, front and back, which are usually ID Cards, passports, driver's license, etc.

Step 2: Extract customer information automatically by OCR. The OCR technology of FPT.AI is built on an artificial intelligence platform, giving results with an accuracy of 98% for common

documents such as ID cards, passports, driver's licenses, etc. Customers can check and edit this information after extracting it.

Step 3: Compare photos on identity documents with real faces through selfies or videos. If they do not match, customers must proceed to re-verify.

eKYC optimizes banking operations

Not only does it bring satisfaction to customers but eKYC also supports banks to optimize their activities.

Being done completely by machine, the eKYC process has high security, reduces errors in data entry, and detects fake documents better than traditional methods. Besides, eKYC helps businesses to store and take advantage of abundant data resources, which are digitized, to gain deep insights about potential customers, helping businesses to create efficient marketing campaigns.

With those benefits and opportunities, it can be sure that electronic Know Your Customer will change the face of the banking industry in the next 5 years.

3. FPT.AI eKYC - The best eKYC solution for banking in Vietnam

In Vietnam, FPT.AI eKYC is equipped with many state-of-the-art technologies, such as:

- OCR technology: Extract information on identity documents with an accuracy of up to 98%.

- Fraud Check technology: Verify information on identity documents, solve the problem of fake documents

- Facematch technology: Evaluate matching rate between faces on identity documents and real-life photos/videos

- Liveness detection technology: Verify a person as a living entity

Thanks to the eKYC solution, the online account opening process can be done simply and quickly, offering more positive experiences for customers. Besides modern technologies, FPT.AI eKYC is also known for its 3 outstanding features: high security, easy integration into available systems, and stable operation.

Despite many challenges, in general, the potential of eKYC adoption in financial organizations is tremendously promising. By combining the most advanced technologies in the market, as well as continuously improving features, FPT.AI confidently provides the best eKYC solution in Vietnam, accompanying the development of commercial banks in the digital era.

----------------------------------

👉 Experience other #FPT_AI products at: https://fpt.ai/vi

🏬 Address: 7th floor, FPT tower, 10 Pham Van Bach, Cau Giay district, Hanoi

☎ Hotline: 1900 638 399

📩 Email: [email protected]