Banking: AI Technology Is Shaping The Future

According to experts, the explosion of AI in banking around the globe is expected to create $1 trillion in annual value. The development of AI drives the banking industry to transform powerfully, enhancing experiences for new generations of customers in the 4.0 era.

The banking industry as a pioneer in technology adoption throughout history

In the past decades, the banking industry has improved many methods to interact with customers and adopted modern technology to handle important tasks. In the 1960s, the first ATM was installed. 10 years after that, customers could use cards to make transactions and payments. In the early 21st century, Internet Banking, or Online Banking, was introduced and became popular. In the 2010s, smartphones were born and led to the boom of Mobile Banking. This development does not stop when banking services are available on websites and apps. The digital age opens many opportunities to use artificial intelligence (AI) in the Finance - Banking industry. AI-integrated banking aims to automate traditional services and work processes by leveraging AI potentials in complicated tasks such as: supporting customers via chatbots and voicebots; opening new accounts, loans; managing risks and making decisions.

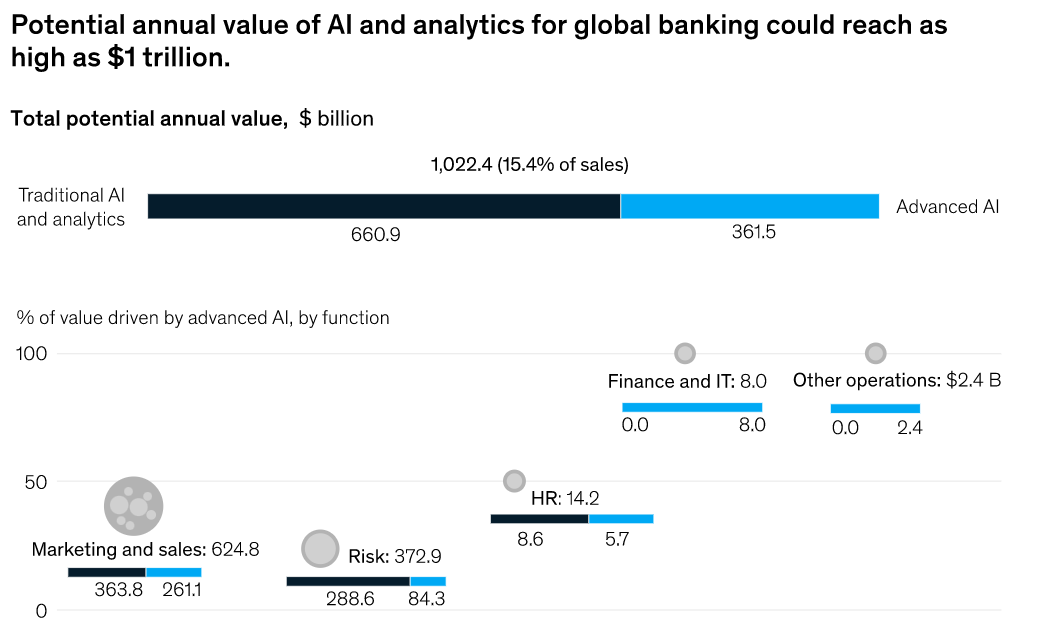

According to a 2018 survey of financial experts by OpenText, 80% of banks have recognized the potential benefits of AI. They have to digitalize their business operations to keep up with the expectation of new generations. A crucial factor that will dominate the banking industry in the next decade is providing customers with instant, personalized, secured services and self-service experiences. According to the article "The executive's AI playbook", published in 2020 by McKinsey, AI can create $1 trillion in annual value for the banking industry. Banks can use AI to automate many operational processes, and thus reduce costs, save time, optimize human resources and improve experiences by 24/7/365 services.

AI can create $1 trillion in annual value for the banking industry, according to McKinsey.

The importance of AI in the digital transformation journey of Vietnamese banks

In recent years, digital transformation and AI adoption are rising in Vietnam and received positive responses from users. The development of technology has changed the way young customers, who are familiar with digital services, approach finance - banking services. These customers always expect to be served speedily and experience personalization. These also are key to creating differences and competitive advantages in banking today. And Covid-19 pandemic is a factor that accelerates the process to adopt tech solutions in the banking industry.

FPT.AI, the leading AI-based solution provider in Vietnam, said that AI can be used in many stages of operational processes of banks, from "front" to "back office". Front office in banking means the department interacting directly with customers to gain revenue. Digital banks use AI algorithms with a user interface to provide high-quality services, such as chatbots and voicebots, helping to maintain and strengthen relationships between businesses and customers. With more specialized tasks, AI support banks powerfully to assess risks, detect and prevent frauds, and perform KYC. Most large banks around the world have implemented eKYC and biometric technology, which allows customers to make transactions using their faces, voices or fingerprints. For tasks in back offices, AI is integrated into OCR technology and helps recognize and extract information on documents accurately. This is an important solution to digitize and store data. Many large banks choose FPT.AI Reader to digitize their documents, including contracts, bank statements, and identification documents such as ID Card, etc. It gives results with an accuracy of up to 98%, easing the burden of manual tasks for banks' personnel.

In Vietnam, one of the most outstanding banks adopting technology is Tien Phong Commercial Joint Stock Bank (TPBank). TP Bank started its digital transformation early and has a strategic investment in technology with more than 80% of its technology using AI. TPBank said that AI is a crucial factor in its digital transformation strategy. To take advantage of AI as its key technology and foundation for innovation, TPBank has boldly invested in and implemented AI during the past few years, and successfully adopted AI in many products, services. The year 2022 is a pivotal year when TPBanks determines to adopt AI comprehensively, aiming to develop its business in digital platforms and increase its competitive advantages.

LiveBank - TPBank's smart online transaction model

The Industry 4.0 and Covid-19 pandemic accelerate digital transformation processes of banks in Vietnam to adapt to the new normal. Experts say that AI technology is the top choice of banks in this digital era, which helps them in the race to win customers, decrease costs of human resources, improve their ability to process data, enhance performance and customer experience.

In a digital environment driven by many intangible assets - high-tech intellectual products, Vietnam's banking industry needs to quickly adapt and establish a powerful digital transformation framework, and apply advanced tech solutions to create an open ecosystem for the finance-banking industry. Technology powers banks to grow stronger and more friendly while reducing potential risks, providing convenience, and meeting the increasing demands of modern customers.

On November 26th, 2021, the online conference "AI-integrated bank: The future of banking" will be held by FPT Smart Cloud and Microsoft, with the participant of TPBank's representative. The conference has leading Vietnamese and global experts, who will provide a comprehensive view of artificial intelligence adoption in banking around the world and the most effective implementation strategy.

REGISTER NOW AT: https://webinar.fpt.ai/ai-powered-banking