FPT.AI Credit Scoring – A customer credit scoring solution

Consumer loan is one service most encouraged by banks and financial institutes, as most loans are small in scale, but large in numbers, with high interest and stability. There is also the birth of various credit scoring services along with the rise of the financial market. Knowing these needs, FPT.AI Credit Scoring had been born to help financial institutes solve the problem of crediting scoring individual customers.

The problem for FPT.AI Credit Scoring

Credit Scoring is a method to evaluate customers’ reliability, which consider various elements like personal income (financial score), loan history (mortgage score), personal reliability (social score), and identity (who is the borrower, their ID card, their household).

For customers with previous credit transaction history who want loans for businesses, the borrowing limit will be calculated and referenced from their credit scores made by the Credit Info Center CIC, State Bank of Vietnam. But what of those without credit history, then?

In this 4.0 era, the technological trends of Big Data, as well as automatic AI-based credit scoring models are starting to transform credit scoring. In order to improve efficiency of customer information and credit scoring for individual customers, financial institutes need to diversify their information sources and data gathering method. And FPT.AI Credit Scoring was born in acknowledgment of these market demands. In particular, FPT.AI Credit Scoring a credit scoring method for individual customers using data from social media, as well as from e-commerce platforms. It is also a highly reliable credit scorer, utilized by various financial institutes.

FPT.AI Credit Scoring integrates Big Data and Machine Learning technologies, thus has the ability to analyze and score credits based on SNS data in Vietnam, with over 60 million accounts.

FPT.AI Credit Scoring is suitable for financial institutes whose target customers are young individuals, without previous credit history. These people often want unsecured debts, or installment loans to buy necessary appliances like motorbikes, laptops, mobile phones, televisions, refrigerators, which amount up to around tens of millions, in about 1-2 years. These loans, while low in value, are plentiful in numbers, bringing about high returns for financial institutes with their low risk, low-pressure nature on a set capital. Thus, they are the cream in finance-banking, with enormous amounts of customers that everyone craves a share of.

FPT.AI Credit Scoring quickly issue credit scores based on customers’ reliability and identities. In only a couple seconds, the FPT.AI Credit Scoring system will analyze customer data, score their personal reliability, and return corresponding credit scores from 0-1. Aside from traditional credit scoring methods, financial institutes can use these scores for a general overview of a customer’s reliability and honesty. Then, they can assess riskiness of a loan before deciding on whether to issue the loan, how long will the loan be, and which interest to impose… If the customer has got a good credit score, then they may have higher credit limits and better interests…

The mechanism of FPT.AI Credit Scoring

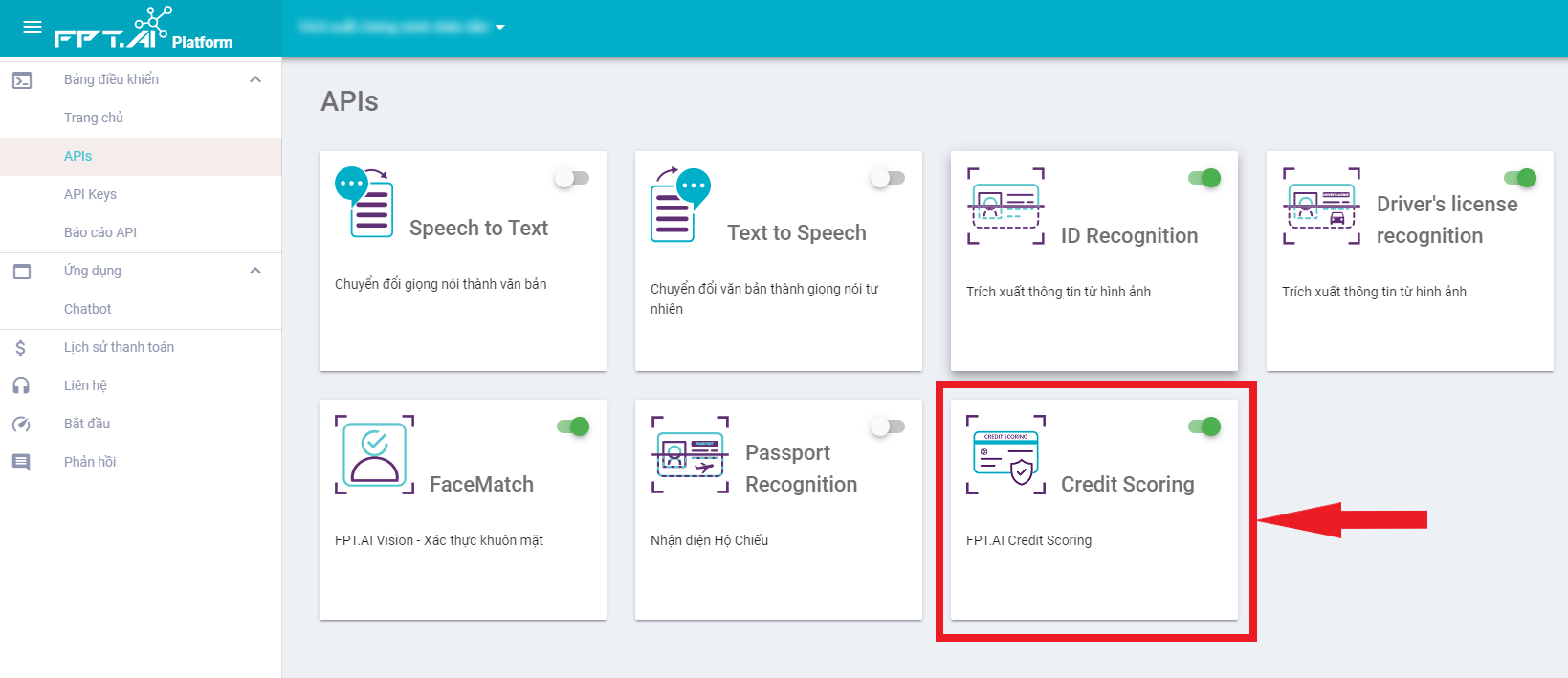

To assess your customer’s credit score, first, log in to FPT Console, then select API Credit Scoring.

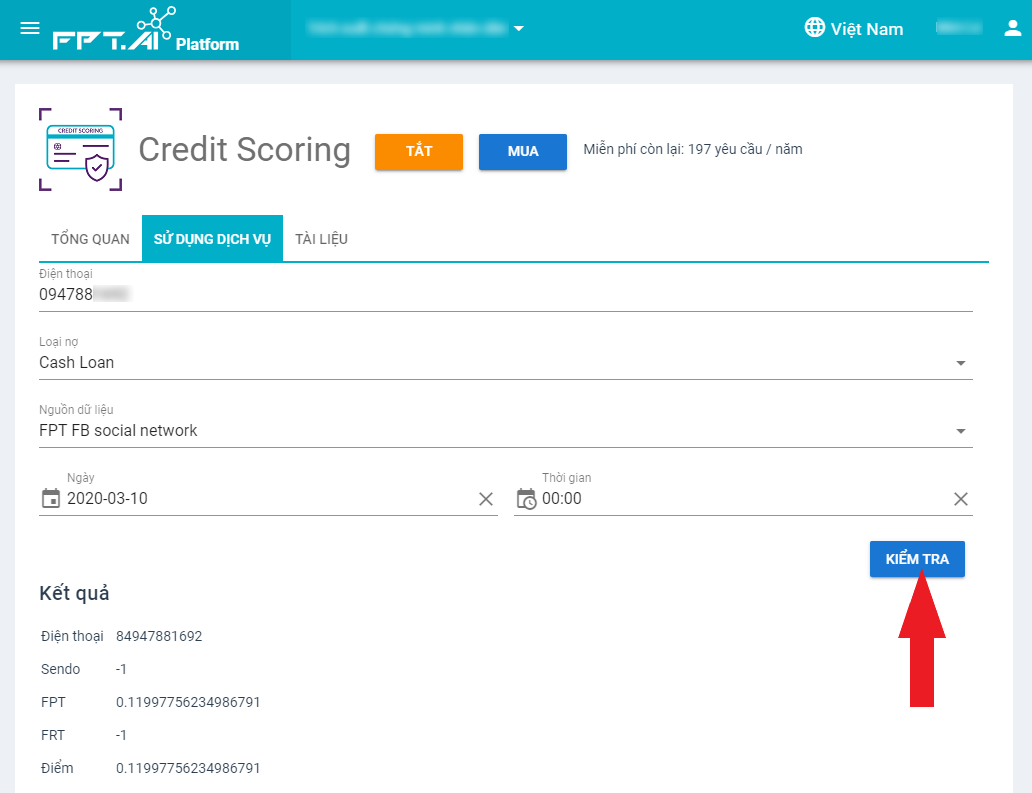

In API Credit Scoring, enter information in the blanks following the below instructions:

Step 1: Enter the phone number of the customer you want to score.

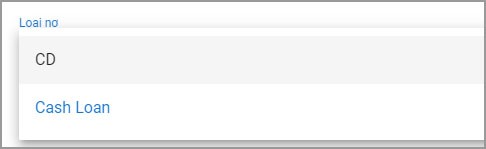

Step 2: Choose the type of credit loan that the customer wants to score based on that type.

There are two types of CD loan: Consumer Loan and Cash Loan.

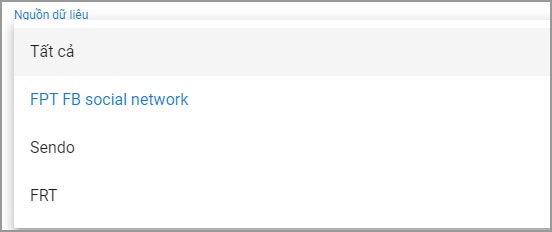

Step3: Choose the database.

Currently, FPT.AI uses data from FPT FB social networks to evaluate credit scores.

In the future, FPT.AI will also utilize data from the e-Commerce platform Sendo and FPT Retail (including FPT Shop, F.Studio by FPT). These are among esteemed retailers with enormous customer bases, and will be used for credit scoring.

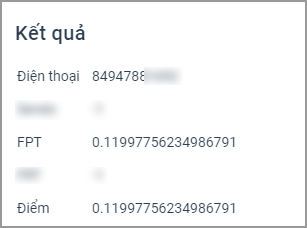

Step 4: Return results

Credit scores from FPT.AI Credit Scoring will be from 0 to 1. The higher the risk, the closer the scores are to 1. Example: Credit score of the above phone number is ~0,119978, a rather high band.

Advantages of FPT.AI Credit Scoring

Access to enormous amounts of customers

According to a report from Social Media Stats, 57.43% of Vietnamese use SNS, and this number will continue to rise. Therefore, analysis done via SNS data will help financial institutes understand better about the life and hobby of their consumers, at the same time can evaluate customer reliability and identify customers.

Quicken the pace of loan record appraisal

In retail banks or consumer finance companies, with prime loans with low amounts and high quantities, traditional methods are starting to lose competitive advantages in speed, cost, and accuracy. If collaborated with the Credit Info Center CIC, some records will take up to 5 days from results. However, with FPT.AI Credit Scoring, only a few seconds is needed to evaluate personal reliability and perform customer identification using the SNS behavior history analyzed by the system.

Competitive costs

A better product, along with appropriate costs – all are possible with FPT.AI Credit Scoring.

Particularly, information from non-conventional channels is starting to gain popularity in data science applications, especially in building credit scoring models, creating breakthroughs in the field for the majority of customers. FPT.AI Credit Scoring can give immediate results, with competitive costs, and thus hold promises to become a useful assistant for financial institutes to assess their customers and make accurate decisions.