Hiện nay, chatbot đang dần trở nên phổ biến với các doanh nghiệp trên khắp toàn cầu. Chúng có thể dễ dàng tích hợp trên nhiều nền tảng nhắn tin khác nhau. Tuy nhiên, thách thức lại nằm ở việc làm sao để xây dựng được một chatbot mang lại nhiều giá trị cho người dùng. Đó chính là nhiệm vụ vô cùng quan trọng của người thiết kế kịch bản. Vậy, làm thế nào để tạo ra một kịch bản chatbot hấp dẫn và thú vị?

Hãy cùng tham khảo các “bí kíp” vô cùng hữu ích sau:

1. Hiểu rõ người dùng tiềm năng của bạn là ai?

Để có thể xây dựng được một AI chatbot thành công, đầu tiên, người tạo kịch bản phải hiểu rõ sản phẩm/dịch vụ là gì, đối tượng mục tiêu là ai, mục đích bot phải hướng đến, tiện ích mà chatbot cung cấp cho người dùng?

Mục đích xây dựng chatbot có thể là giải trí, bán hàng, cung cấp tin tức… Khi bạn tìm hiểu kĩ về sản phẩm/dịch vụ và đặt ra các câu hỏi, câu trả lời, những sự lựa chọn đúng đắn, phù hợp với khách hàng, bạn sẽ tạo ra được những kịch bản chatbot thông minh và thân thiện với người dùng hơn.

2. Mở đầu cuộc trò chuyện

Để bắt đầu cuộc trò chuyện, chatbot có thể chủ động bắt chuyện trước với người dùng. Khi chatbot gửi đến khách hàng một lời chào thân thiện thể hiện sự đón tiếp nồng nhiệt, khách hàng sẽ cảm thấy thoải mái và cởi mở hơn.

Nếu chatbot được xây dựng với mục đích đặc thù dành riêng cho 1 sản phẩm hoặc dịch vụ nào đó, các chủ đề chính nên được giới thiệu cho người dùng ngay ở những thông điệp chào mừng đầu tiên để cuộc trò chuyện có thể đi đúng hướng.

Một chatbot không nên tư vấn nhiều chủ đề, lĩnh vực khác nhau, tránh tình trạng lan man, không đi sâu được vào mục đích chính mà người dùng cần hỗ trợ.

Nên hiển thị các câu hỏi đến người dùng theo thứ tự những câu hỏi thường gặp đến những câu hỏi ít gặp hơn.

3. Thiết kế luồng tương tác chatbot

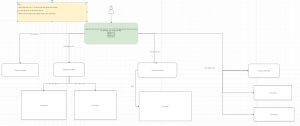

Chatbot được xây dựng để hiểu ý định của người dùng. Do đó, người tạo kịch bản chatbot phải hiểu được những ý định đó của khách hàng. Mỗi cuộc trò chuyện của khách hàng được ví như một cái cây hội thoại, dẫn dắt người dùng đi theo các hướng, để người dùng có thể đưa ra các luồng quyết định đối với từng sản phẩm. Khi người dùng trả lời câu hỏi theo một chiều, họ sẽ đi đến một nhánh câu hỏi mới. Nếu họ trả lời khác, họ sẽ đi đến một nhánh khác. Do vậy, trước khi tạo kịch bản hoạt động cho chatbot, người tạo kịch bản phải vạch rõ ra các luồng thông tin gồm tất cả các tình huống mà cuộc trò chuyện có thể đưa người dùng đến.

4. Kết nối chatbot với cơ sở dữ liệu của hệ thống chung

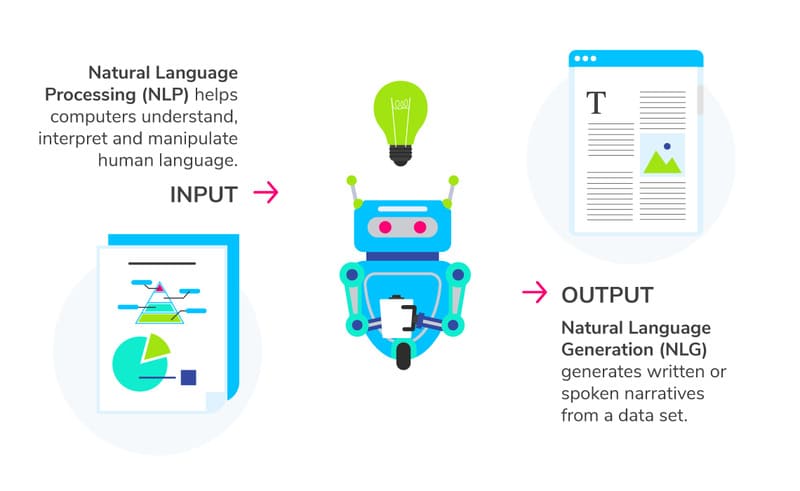

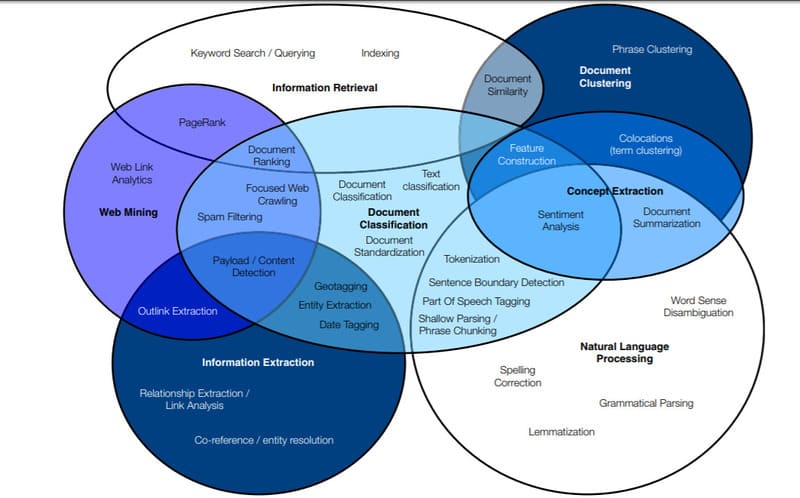

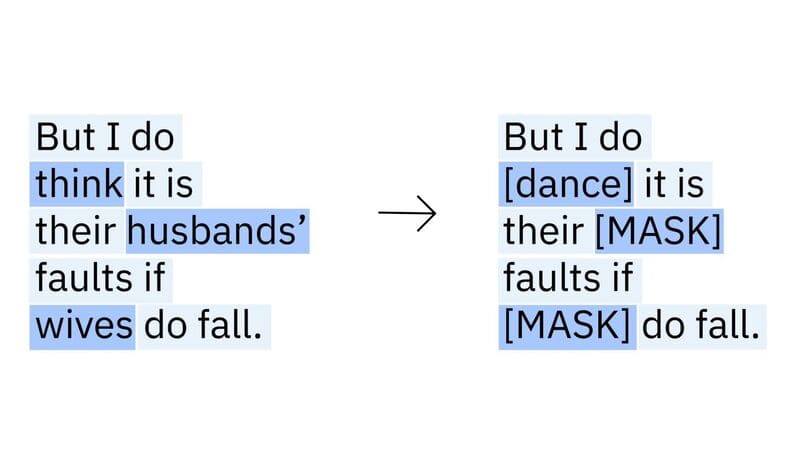

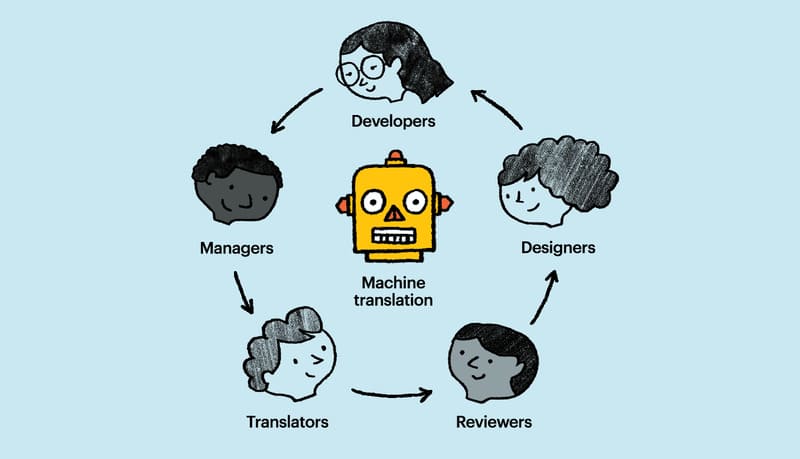

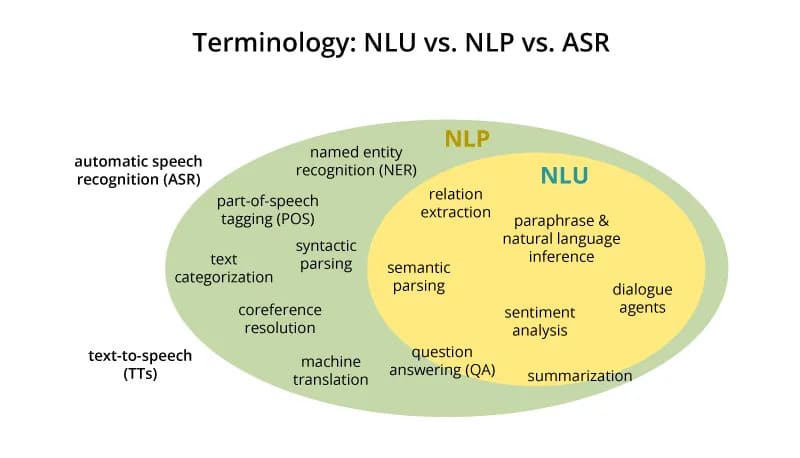

NLP là công nghệ xử lí ngôn ngữ tự nhiên, có khả năng phân tích cú pháp và nhập văn bản miễn phí để xác định ý định của người dùng. Sau đó, chatbot sẽ cung cấp nội dung hoặc các hành động liên quan đáp lại yêu cầu đó của người dùng. Nói cách khác, nhờ có NLP, chatbot có thể hiểu được những gì người dùng cần và đưa ra những câu trả lời chính xác nhất.

Ví dụ: Khách hàng nhập câu: “Tôi muốn mua 1 chiếc điện thoại iphone X”

- Câu trên khách hàng có ý định: Mua hàng

- Số lượng: 1 chiếc

- Tên sản phẩm cần mua: Iphone X

1 NLP như trên cần có kết quả để trả lời khách hàng rằng sản phẩm Iphone X còn hàng hay hết hàng. Và kết quả đó được lấy từ cơ sở dữ liệu của hệ thống. Do đó, chatbot phải được tích hợp vào cơ sở hạ tầng thông tin chung của doanh nghiệp, để bot cập nhật liên tục danh sách sản phẩm, số lượng hàng hoá và nhiều dữ liệu khác. Từ đó, chatbot có thể nhanh chóng đưa ra câu trả lời đến người dùng.

5. Kết nối linh hoạt nhiều luồng thông tin

Để kết nối nhiều đoạn hội thoại với các ý định khác nhau của người dùng, bạn nên tạo ra nhiều tuỳ chọn cho khách hàng bằng cách sử dụng linh hoạt các thẻ trả lời dưới nhiều hình thức khác nhau, không chỉ dưới dạng văn bản mà còn là thẻ hình ảnh, slide ảnh, form… Bằng cách đó, bạn có thể điều hướng người dùng từ luồng này sang luồng tiếp theo mà họ không cần truy cập lại menu chính. Làm cuộc hội thoại trở nên tự nhiên hơn.

Ví dụ, hãy tưởng tượng, bạn đang thiết kế một chatbot dạy mọi người các công thức nấu ăn từ khắp nơi trên thế giới. Trong cuộc trò chuyện của bạn sẽ xuất hiện một số thực thể sau: tên món ăn, công thức, tác giả/đầu bếp,…

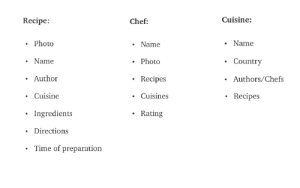

Mỗi thực thể này sẽ có các thuộc tính riêng của chúng như:

Giả sử, người dùng hỏi chatbot ý tưởng về công thức nấu các món ăn cho bữa tối, chatbot có thể trả lời bằng thẻ slide ảnh với một loạt các công thức nấu ăn. Mỗi thẻ sẽ hiển thị các thuộc tính phù hợp nhất của thực thể này như: ảnh, tên món ăn, tên tác giả, cách nấu.

Khuyến khích người dùng phản hồi nhanh chóng bằng cách nhập câu hỏi/ câu trả lời hoặc nhấn nút lựa chọn, để người dùng có thể thoải mái tham gia vào cuộc trò chuyện với bot.

Bạn cũng có thể thêm nhiều tuỳ chọn bằng cách kết nối thực thể này với các thực thể khác dựa trên các thuộc tính của chúng.

Nếu bạn thực hiện theo định hướng trên, người dùng sẽ được điều hướng từ Công thức (Recipe) đến Tác giả (Author) mà không cần phải thoát khỏi luồng hội thoại để bắt đầu lại. Điều này mang lại cho người dùng một trải nghiệm liền mạch và tự nhiên.

Bài tiếp theo, FPT.AI sẽ gửi đến các bạn 5 bí kíp cũng vô cùng giá trị để có thể tự tạo được những kịch bản hấp dẫn, thú vị nhất cho chatbot của mình.