FPT.AI Vision can process thousands of images at the same time, only takes 2-3 seconds to input data while manual work takes 3-5 minutes.

According to The World Bank in Vietnam, in many countries, eKYC (electronic Know Your Customer) solution is the development priority in the field of banking and finance to accelerate the growth of the digital economy. eKYC replaces the traditional customer identification process with face-to-face meetings and paper documents comparison, allowing businesses to digitize this process based on Artificial Intelligence (AI).

In India, the government has built eKYC for citizen data. It allows banks to open accounts for people who do not access financial services without troublesome paperwork and procedures. Besides, businesses can easily authenticate electronic payments from users based on biometric information such as fingerprints, or OTP codes via SMS.

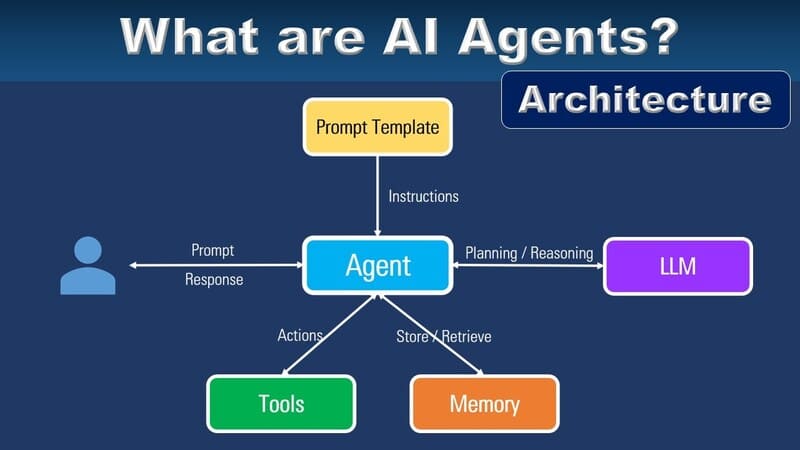

Being on-trend, some Vietnamese technology companies are also working on the electronic Know Your Customer solution. FPT.AI Vision is developed based on Artificial Intelligence, applying the advances of deep learning. It is an automated system that processes, identifies and extracts multilingual information from images, such as ID Card, driver’s licenses, forms or invoices.

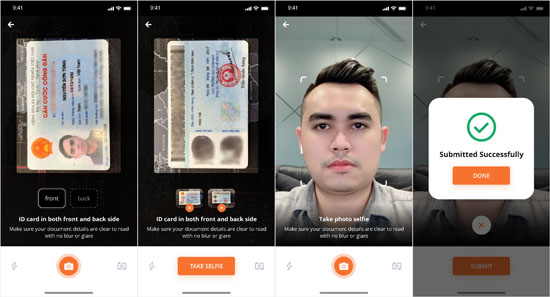

FPT.AI Vision solution interface.

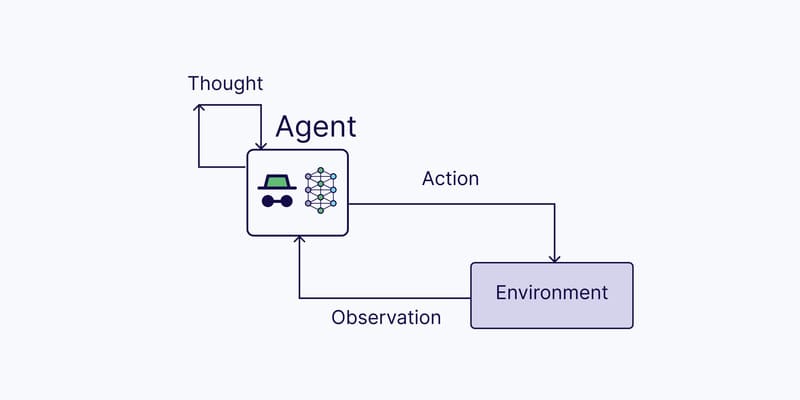

According to FPT’s representative, the operation of this solution is based on biometrics authentication technology, AI, etc. It also builds a database of user identity. When businesses need to input, check and collate personal information of customers, the system takes only 2-3 seconds to complete while the manual data entry process usually takes 3-5 minutes.

The representative took a bank applying FPT.AI Vision in shareholder identification for example. Shareholders are required to enter their emails, phone numbers, send a photo or scan their ID. After that, the system automatically extracted, stored and collated information with the database. Shareholders just need to take portraits for AI to assess the matching degree. Then FPT.AI Vision sends emails to them to confirm their registered emails. “Each task is processed by AI in maximum 2 seconds,” the representative emphasized.

Mr. Ho Viet Dung, a manager at a financial institution using electronic Know Your Customer solution, shares that “When we upload thousands of ID Card photos at the same time, in a snap, FPT.AI Vision displays all the personal information of customers on the screen”.

According to FPT, shortening the customer identification process helps companies save time and labor costs by 70%, as well as improve customer experience. Besides, the solution shows its superiority by improving security, preventing risks in the customer authentication process, detecting cases of using 3D masks or video playback, etc.

In terms of deploying FPT.AI Vision, the representative of FPT said that businesses could immediately use it. The cost is based on the number of photos that need to be extracted to the system or the number of transactions that customers have successfully verified. Currently, FPT has put this smart system into big banks such as TPBank, MBBank …

——————————————–

![]() Experience the #FPT_AI products at: https://fpt.ai/en/

Experience the #FPT_AI products at: https://fpt.ai/en/

![]() Hotline: 0911886353

Hotline: 0911886353

![]() Email: support@fpt.ai

Email: support@fpt.ai