In an era dominated by online transactions, ensuring secure and reliable biometric identity verification processes has become more critical than ever. Built on cutting-edge Artificial Intelligence (AI) technology, FPT AI eKYC is an electronic identity verification solution widely adopted by banks in Vietnam to streamline the customer verification process.

Biometrics involves measuring and analyzing unique physical and behavioral traits of individuals, offering a reliable, secure, and accurate method for identity verification. In the eKYC process, biometric data such as facial features or fingerprints are collected and compared with stored templates to verify an individual’s identity remotely. This ensures that only authorized individuals can access financial services, minimizing the risk of identity theft and financial fraud.

Effective July 1, 2024, Decision 2345/QĐ-NHNN mandates the implementation of biometric authentication for online payment and banking card transactions to enhance security. For transactions exceeding VND 10 million per instance or cumulative transactions exceeding VND 20 million in a day, subsequent transactions on the same day will require facial biometric authentication. For transfers under these thresholds, Smart/SMS OTP authentication remains sufficient, with no need for facial authentication.

Additionally, under Article 2 of Decision 2345/QĐ-NHNN, customers must undergo biometric authentication prior to their first transaction via mobile banking applications or when accessing the system from a new device.

Facial recognition has emerged as the most prevalent form of biometric technology, revolutionizing electronic identity verification methods. The accuracy and convenience of FPT AI FaceMatch technology are fully integrated into the FPT AI eKYC solution. By analyzing billions of unique facial points—such as the distance between the eyes, nose shape, and jawline—FaceMatch algorithms generate a unique biometric profile for each individual. This profile is cross-referenced with identity documents such as passports, citizen identification cards, or driver’s licenses to confirm the user’s identity.

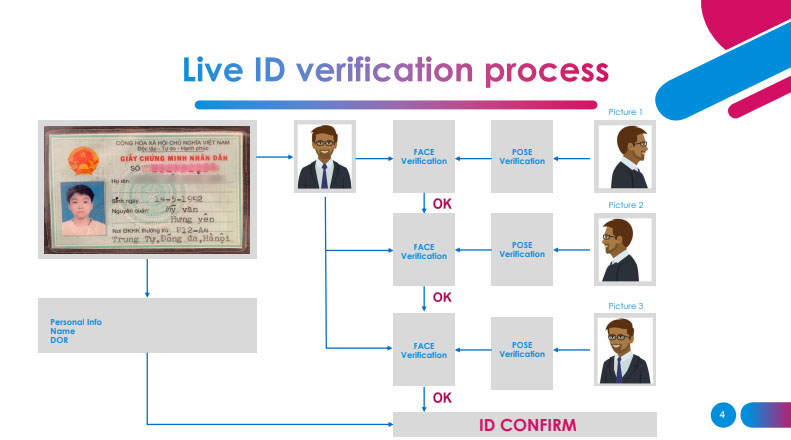

Beyond facial recognition, FPT AI eKYC incorporates advanced features such as Fraud Detection and Liveness Detection. These capabilities, leveraging video-based verification rather than static images, enhance accuracy and minimize fraud risks, offering a comprehensive and user-friendly electronic identity verification process. Customers can effortlessly capture photos, record videos, or interact directly with the system via smartphones or webcams anytime, anywhere, to open accounts, verify identities, or perform high-value transactions. The Fraud Check technology integrated into FPT AI eKYC ensures the authenticity of identity documents, detecting falsifications, modifications, or tampering. By eliminating the need for physical paperwork or in-person visits, the solution significantly reduces operational risks while providing customers with a seamless and modern experience. Deep learning algorithms enable the system to compare identity document images with real-time photos, drastically reducing the time required for customer identification and verification.

FPT AI eKYC is highly versatile, applicable in scenarios such as online account openings and other digital services. With OWASP-standard security, it includes advanced defenses like two-tier facial anti-spoofing to ensure high-accuracy customer identification. The solution also integrates state-of-the-art features such as MRZ reading and NFC chip scanning, enabling the recognition of 18 fields of information, including portrait photos on new chip-embedded citizen identification cards. It ensures the integrity of chip data, verifies digital signatures, and cross-references data with Vietnam’s Ministry of Public Security to confirm chip authenticity.

Compliant with the highest PCI DSS security standards, FPT AI eKYC is a trusted solution for numerous banks, financial institutions, and investment organizations. It empowers businesses to enhance their competitive edge and attract tech-savvy younger customers with its superior features and convenience.