Covid-19 pandemic is a health crisis, as well as a shock to the global economy. In that situation, banks have to change business activities to strongly go through the difficult period.

Banks play an important role in the economic structure of each country. Right and timely measures can significantly reduce the damage caused by the Covid-19 crisis. “Gold is tempered by fire, brave men by adversity”, the role of business administrators is proven and leveraged in this difficult time. Every decision of the head will directly affect the future of the business.

The impact of Covid-19 on the global banking industry

In the report “Covid-19: WhattoDoNow, WhattoDoNext”, Accenture points out that Covid-19 cripples the economy and has short-term impact on 4 important factors of the Banking industry that are:

- Credit management: Bad debt will increase because consumers and businesses cannot pay off loans.

- Revenue compression: The reduce in interest rate and the decrease in demand will profoundly affect the entire industry. In the first weeks of the pandemic outbreak, the market value of the Banking sector went down to be lower than it was in the crisis in September 2008.

- Provide customer service and consulting: Direct contact limited drives customers to find digital self-service channels and online shopping channels.

- Change the operating and cost monitoring model: The impact on revenue forces banks to increase flexibility in business activities, consider short-term priorities and have a plan to respond to the potentially prolonged pandemic.

Applying technology to solve problems of service in the Banking industry

The social distancing regulation of the government has caused changes in how businesses provide customer service, especially in Banking. A few branches are still opened to maintain important services with a small number of employees. Customers also move to digital interactive channels such as apps, digital banking, etc. What are the responses of banks to this drastic change?

The development of AI technology supports the Banking industry to quickly solve 2 of the 4 above factors, which are problems in customer service, optimizing the operating process to manage costs and maintain activities. The IT Department responsible for the seamlessness of systems has quickly implemented many solutions to provide automated service to customers. One of the most promising and advanced solutions at this time, which is chosen by many banks to handle the problem in customer service, is Artificial Intelligence (AI). Technology has been helping banks to open a sustainable value chain. Adopting technology now is a necessary and right step positioning a digital bank in the future.

In Vietnam, FPT.AI is one of the most excellent Artificial intelligence platforms and the only platform to receive the Excellent Digital Platform award from the Ministry of Information and Communications. FPT.AI platform brings businesses, especially the Banking sector, a comprehensive solution kit to digital transformation. In 2020, many large banks has chosen and integrated AI solutions into their operating processes:

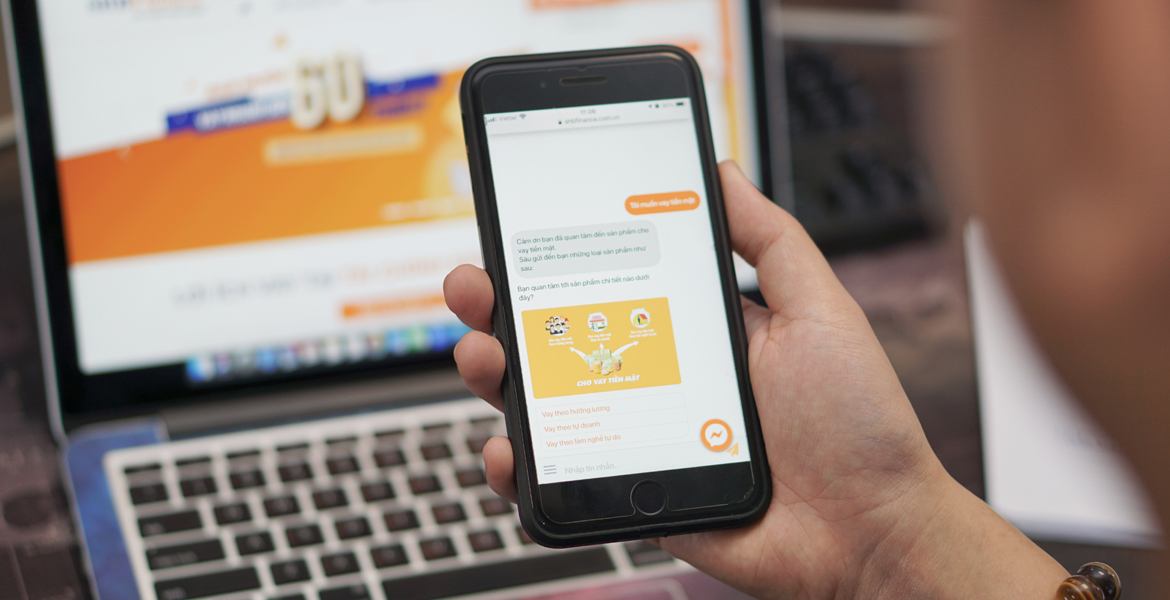

Chatbot: Smart chatbots have the power of advanced AI technology, connecting and maintaining strong relationships between businesses and customers. Chatbots are equipped with Natural language processing technology, Machine learning, etc. to understand the intent of customers, thereby giving corresponding responses. AI Chatbot can automate many common and important operations in businesses. One can say that Covid-19 pandemic has completely changed businesses’ opinions on technology adoption for customer service.

AI Virtual Agent for Call Center is integrated into customer service systems of traditional call centers and has the ability to automatically carry out inbound, outbound calls or calls following scenarios. In such industries with high frequency of customer interaction as Banking, Virtual Agent is the optimal choice. Many large banks in Vietnam have initially applied FPT.AI Virtual Agent for Call Center to perform tasks, from simple to complex ones, such as: Notify appealing promotions, remind credit loan payment schedule, renew bank book, credit card, etc. Besides understanding customers’ requests or forward requests to the right employee, Virtual Agent also can automatically handle them without humans.

electronic Know Your Customer eKYC allows customers to perform the online verification process every time, every where, without directly going to transaction offices. Customers do not need to wait in lines and fill in many forms but open bank accounts quickly.

When facing many challenges caused by COVID-19 crisis, banks are forced to find the most optimal solution to maintain business activities, support customers and optimize costs as much as possible. Investing in smart technology solutions, shifting the focus of the workforce away from repetitive, time-consuming transactions, as well as enhancing specialized skills of human resources are how banks can overcome a difficult year and get prepared for the coming challenges in 2021.

———————————-

Experience FPT.AI’s solutions at https://fpt.ai/

![]() Hotline: 0911886353

Hotline: 0911886353

![]() Email: support@fpt.ai

Email: support@fpt.ai