An important approach to disrupt the traditional insurance industry is prioritizing digital and IT development. Grasping the future trends of the insurance industry, FPT.AI pioneers in providing FPT.AI Conversation solution – the leading chatbot building and management platform based on artificial Intelligence in Vietnam, proactively creating a seperate way for businesses in a dynamic insurtech market.

1. The Insurance Industry 4.0: A new and dynamic game

What is insurtech?

Insurtech, a term combining the words “insurance” and “technology”, is used commonly in the recent 6 years, representing technology adoption in operating and managing insurance business activities. By using artificial intelligence (AI), big data, internet of things, etc. to handle tasks of insurance brokers and personalize customer support, Insurtech companies have created a revolution that profoundly changes the way the traditional insurance industry operates.

Insurtech – The inevitable trend in Vietnam’s insurance industry

The insurance industry is considered slow to apply technology advances to business models due to its operations, document processes for each case. However, digital transformation is changing consumers’ habits and behaviors, especially for young customers.

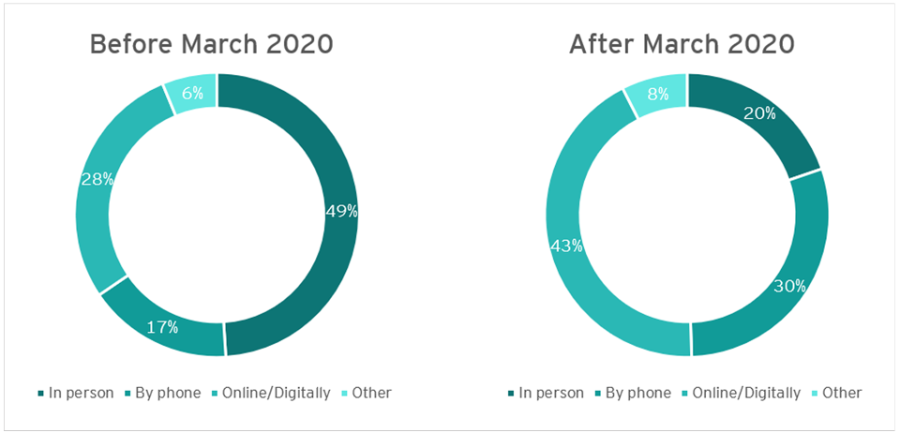

According to Ernst & Young’s 2020 survey, 73% of respondents prefered having insurance consultants online or through their phones to direct contact, and this number soard after Covid-19 pandemic spread around the world. An obvious trend happening is that customers favor online claims, and businesses are gradually automating their claim handling processes by technology platforms.

Data of EU (France, Italia), Global Insurance survey by EY in the late 2020.

Facing huge potentials in the domestic market as well as the pressure from Covid-19, insurance companies are forced to embrace technology transformation and automate their operations to adapt to the change. According to ResearchAndMarrkets.com, Insurtech revenue would increase by 10.8% per year from 2019 – 2025 and reach USD10.14 billion in 2025. Therefore, financial experts stated that Insurance would reshape the future of Vietnam’s insurance industry. Tech innovation adopted in operations will help insurance companies get closer to their customers.

2. Benefits of chatbots for Insurtech companies

Some important technologies are driving the development of Insurtech, including chatbots – the most popular way for an Insurtech business to interact with customers. Cognizant’s report in 2019 considered chatbots the core strength of insurtech. It is “essential in businesses having focused vision on modernizing business activities and digital customer experience.

There are 4 factors that affect the usage of chatbots in insurtech companies:

? The same requests from customers

In many cases, customers usually ask repetitive questions and simple queries. With pre-programmed scenarios, chatbots help filter those requests before forwarding complex tasks to humans. As a result, customers can experience seamless and fast service, easily go through simple procedures such as: asking about consumer loan packages, insurance fee, payment method for insurance packages, etc., and Insurtech companies can gain benefits of optimizing their human resources.

Chatbots is one of the successful AI applications at VietinBank Insurance so far. VietinBank has built and implemented a chatbot based on FPT.AI Conversation platform to support customers in handling basic tasks, such as consulting on personal finance, answering FAQs, supporting customers to use its products, etc., thereby bringing the most seamless and outstanding experience with insurtech to customers.

? 24/7 service

24/7 service is an increasing demand of consumers, especially in the digital age when convenience is the top priority. Grasping this demand, Insurtech companies are likely to design their services following a 24/7 framework. Customers can easily interact with insurance companies through chatbots without a system with employees working 24/7.

? Automation to reduce costs

According to Juniper’s report, in 2022, chatbots would save more than $8 billion for businesses, especially in customer support activities. This technology research company also predicted that the total insurance costs created by AI would reach USD20.6 billion in 2024. Thus, chatbot solutions will be powerful assistants that replace hundreds of customer support employees in insurtech companies, helping them to reduce costs of building traditional customer service systems.

? Marketing for businesses

Attracting customers drives business activities but it is not easy. Insurtech can bring potential customers to services of companies, and thus increase value conversion. Through chatbots, insurtech companies can collect data of user behaviors, thereby helping companies to focus on target customers and potential customers in the future.

3. FPT.AI Conversation – Outstanding chatbot that leads the market

Understanding the strong connection between customers’ need and benefits of insurtech companies, FPT.AI has produced Automatic Conversion Platform – Chatbot (FPT.AI Conversation), allowing businesses to easily create and manage chatbots on user interface to provide excellent experience with customer service. The chatbot has outstanding features compared to others in the market:

✅ Build natural conversations: Based on AI technology, equipped with Machine Learning and the leading Vietnamese natural language processing technology in the market, FPT.AI’s chatbots can understand customer intent, then give appropriate answers and become smarter after training.

✅ Support marketing: AI chatbot of FPT.AI allows users to build and manage conversations with customers according to their experience journey with products/services and automatically send information about promotion to customers.

✅ Multi-channel implementation: FPT.AI Conversation can be integrated with business internal data, as well as popular messaging platforms such as livechat on websites, social media (Facebook, Zalo, Viber, etc.), through some simple steps.

✅ Compatibility and the ability to scale up: Easily integrated with businesses’ systems through APIs. Cloud platform allows the chatbot to flexibly scale up and handle thousands of customers’ intents at the same time. FPT.AI’s chatbots replace thousands of customer support employees, automate processes, help record data, store and use data effectively, etc.

In Vietnam, Chatbot built on FPT.AI artificial intelligence platform is one of the top solutions that help businesses in the Finance – Banking – Insurance industry to support customers, thereby changing the game in the traditional market. The collaboration between FPT.AI and leading Fintech, Insurtech businesses such as Home Credit, FWD, etc. has created value by enhancing operational processes, optimizing costs and increasing experiences for customers in the challenging situation caused by Covid-19 pandemic. Chatbots is the most fundamental digital investment that helps Insurtech companies in Vietnam to shape their growth path in the future and avoid being left behind in the insurance 4.0 race.