Security, speed, and convenience are at the forefront of the financial technology revolution. Thanks to outstanding advantages, eKYC – electronic Know Your Customer becomes more prominent than the traditional Know Your Customer (KYC) process. Finance-banking institutions have pioneered applying eKYC to simplify the customer identification process, optimize human resources, and set a driving force in the digital race.

Why is KYC an urgent solution for the finance and banking industry?

Banks and financial institutions are an important part of the national economy. However, they always face risks of fraud, money laundering, appropriation, tax evasion or terrorist financing. Therefore, the government has a strict procedure to investigate and verify customer identities before each transaction. KYC was born and goes with the development of financial institutions and banks.

KYC (Know Your Customer) is a legally required customer identification process for all financial and banking institutions. The process has many levels, from simple to extremely complex, depending on the risk profiles of potential customers.

Traditional KYC process

The KYC process establishes solid trust between customers and financial institutions, as well as unifying and standardizing the customer reception process, which creates a solid and steady shield, protects both customers and businesses from the attack of fraud.

However, with the development of science and technology, the requirements of customers for services are becoming higher and higher, and the “convenience” is the top factor. The thoroughness and complexity of the Know Your Customer process (KYC) gradually reveal limitations, which become a big barrier between customers and businesses.

eKYC – The driving force for the KYC process in the digital race

The electronic Know Your Customer (eKYC) is a breakthrough in the traditional KYC process. With eKYC, customers can do the identification process remotely by themselves on their smartphones without wasting time and effort going transaction offices. eKYC helps banks to simplify paperwork, provide convenience, and improve customer experience. This is a powerful weapon in the digital race of financial and banking institutions.

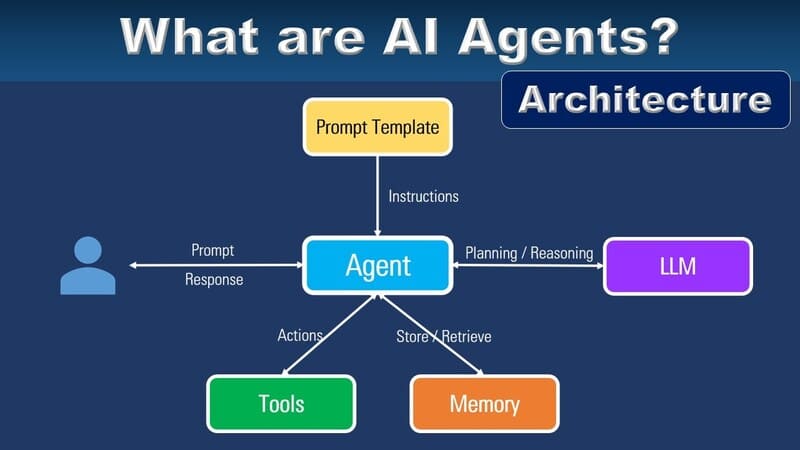

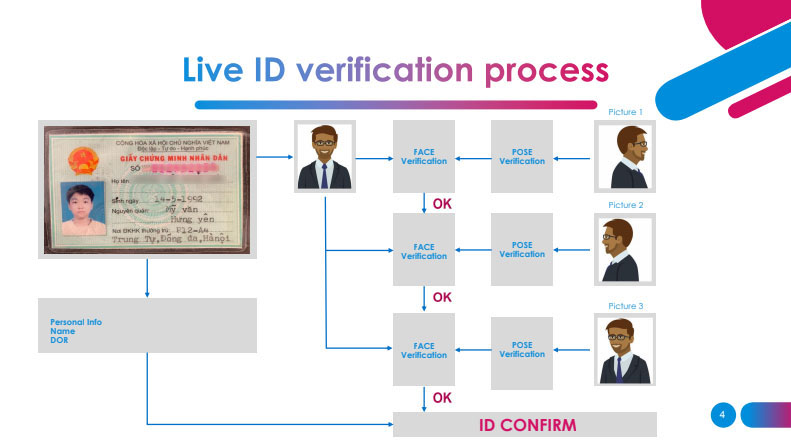

In Vietnam, FPT Technology is one of the pioneers in digital transformation that quickly launches the FPT.AI eKYC solution to meet the needs of many financial and banking institutions. Integrated with many advanced technologies such as Optical character recognition (OCR), Face matching, Head-movement detection, FPT.AI eKYC creates a complete, secure customer identification process with almost absolute accuracy.

In particular, FPT.AI’s eKYC process has specific instructions and simple manipulations, so customers can do it with ease. Hours of procedure and weeks of waiting for verification are now shortened to just a few minutes. Recently, in the online Annual general meeting of FPT Corporation, the FPT.AI eKYC solution was applied to quickly verify shareholders, which only took 2 minutes to complete on average.

The simple 3-step process of FPT.AI eKYC

The eKYC process is completely automatic, so it has high information security, minimizes the risk of identity errors, fake papers compared to traditional identification methods. Besides, eKYC helps businesses store and take advantage of the plentiful data that has been digitized to understand potential customers better and create successful marketing campaigns.

According to Mr. Pham Tien Dung – Director General of Payment Department at the State Bank of Vietnam (SBV): “Speaking about Fintech is speaking about technology, and the first problem in all the banks that we know is electronic KYC. If the eKYC cannot be done, even if it is developed on the internet, while the KYC process is currently requiring face to face meetings, there may be only hundreds or thousands out of ten thousand people in banks’ records are served by meetings. We will miss out on many opportunities and cannot grow.” (Excerpt from the article on Tri thuc tre about the Workshop “Banks & Fintech: Challenges & Opportunities” on November 10, 2017).

The eKYC solution was created to meet the most urgent need of financial institutions and banks, giving businesses the ability to optimize human resources, minimize costs, and provide a positive, modern customer experience. It can be said that eKYC is a “win-win” solution, an inevitable step that every financial enterprise needs to satisfy customers in the digital age.

————————————-

? Trải nghiệm các sản phẩm của #FPT_AI tại: https://fpt.ai/vi/

☎ Hotline: 0911886353

? Email: support@fpt.ai