Many industries are making the most of the power of AI including car insurance. The digital transformation journey of the car insurance industry in Vietnam has made outstanding steps forward with a remote damage assessment solution – FPT.AI CarDamage.

The challenges of car insurance companies

Cars are necessary in the 21st century. Tens of millions of cars are sold each day around the world. This vehicle also poses a potential risk of minor and major auto accidents.

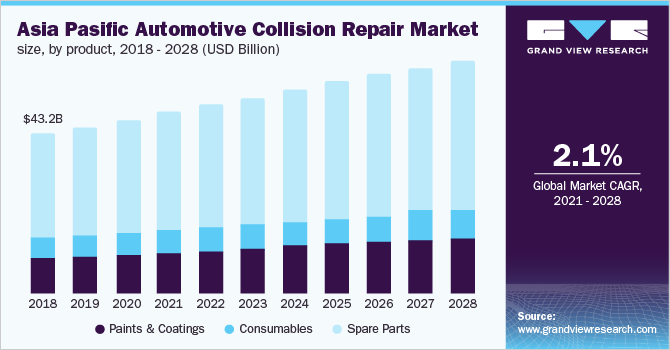

According to a report by Grand View Research, the global auto crash repair market size was 185.98 billion USD in 2020. The CAGR is expected to be 2,1% from 2021 to 2028.

Previously, car damage was assessed directly with the supervision of inspectors. However, this method is time-consuming, causing delays in claim processing and complaints from customers. Subjective assessment by inspectors may lead to inaccurate cost estimation and significant losses. Car insurance companies lose millions of dollars each year because of that reason.

Artificial intelligence (AI) in vehicle damage assessment is being developed by many large countries in Europe, the US, China and Vietnam.

The application of FPT.AI CarDamage in car insurance

The advances in Machine Learning and Computer Vision enable car damage recognition. FPT.AI CarDamage is developed by FPT.AI’s leading engineers and programmers, using AI to process images, detect and assess car damage. This solution automatically analyzes and assess damage quickly with high accuracy.

Detecting car damage automatically speeds up the claim-handling process in the car insurance industry. FPT.AI now can recognize a lot of information related to car condition to analyze and estimate repair costs:

Car information: Brand, color, version, license plate. That information helps to choose components and paint colors to estimate repair costs.

Recognize damage positions and level of damage: Damage positions, parts, level, types, etc. allow the program to understand and quickly assess the damage, and differentiate damage from stains.

Combine with FPT AI Reader to read and extract car owner’s identity documents: Photos are put in front of the scene of incidents.

Especially, when other technologies can only recognize images, FPT.AI CarDamage is the only solution in the market that can detect damage through videos, leading to more accurate and multidimensional damage analysis.

Why should car insurance companies choose FPT.AI CarDamage?

Car insurance, like other insurance companies, actively adopts AI to automate laborious tasks, reduce costs and make data-driven decisions.

FPT.AI CarDamage solutions offer outstanding advantages:

Assess car damage remotely: Car insurance companies can accurately assess car conditions based on built-in sensors and the data (photos and videos) provided by the owners right after their incidents. Thus, FPT.AI CarDamage allows insurance companies to assess car damage remotely through “self-service” data of car owners.

Personalize services: Insurance claims will be processed faster with estimated repair costs being informed in a short time. Costs are based on each brand and type of car and the insurance limit.

Save time and costs of handling claims: Insurance companies do not necessarily send an appraiser to the scene to check the condition of vehicles. In many minor incidents, insurance companies just need to ask vehicle owners to send photos and videos of the scene for the AI system to examine and estimate repair costs. FPT.AI CarDamage solution has the ability to help insurers reduce costs for handling a large number of claims and achieve higher productivity.

Digitalizing the operations of car insurance businesses speeds up and shortens the claim handling process and reduces loss. These advantages not only help insurance businesses to increase customer satisfaction but also reduce operating costs and improve their positions in the digital age.

Find out more about FPT.AI’s solutions and book a consulting appointment: https://fpt.ai/vi/lien-he

Hotline: 1900 638399

Email: support@fpt.ai