Artificial Intelligence (AI) has become a trend while the industrial revolution 4.0 is occurring powerfully around the globe. Not only economic sectors but the Government, non-government organizations are also adopting AI to digital transformation. Especially in the banking industry, most banks determine that AI-powered banking will be the technology driving strong growth in the next decades.

1. Artificial Intelligence – The factor to win “digital-generation” customers

At the seminar “Towards a cashless country” on 19 November, the Deputy Governor of State Bank of Vietnam – Mr. Pham Tien Dung said that 95% of credit organizations already have digital transformation strategies, or are building or planning to build ones. Today about 80 banks are implementing internet banking services, 44 banks are providing mobile banking services, 45 intermediary organizations are providing payment services, more than 90 thousand places are using QR code payment, and there are nearly 298 thousand POSs nationwide. Cashless payment on digital platforms has been growing rapidly recently. In the first 9 months of 2021 only, mobile payments increased 76.2% in number and 88.3% in value; internet payments increased 51.2 % in number and 29.1% in value compared to the same period of 2020.

Other statistics show that by 2025, Vietnam would have a dominant “digital generation” of customers on the market. They would be one of the main forces on the financial market and create new consuming trends. This new generation of customers has high demands and expectations on the quality of financial products, services. When analyzing behaviors of the young generation who are considered “digital native” – the generation was born when the internet had developed strongly, experts say that they are more like perfectionists, demanding customers when it comes to digital experiences. The report “Retail Banking 2020” by PricewaterhouseCoopers (PwC) shows that 40% of customers abandon a bank after a poor experience; on the other hand, enhancing customer experience creates significant competitive advantages for banks in the race to digital transformation.

Besides, the market trend affected by Covid-19 also forces the banking industry to quickly grasp customer expectations across their journey.

As a result, all banks are focusing on developing digital utilities to retain customers and attract new ones. Adopting advanced AI-based solutions, improving cumbersome and slow traditional processes will help the banking industry to conquer that demanding generation of customers. With AI-powered banking model, banks have many potentials in expanding their customer base, providing highly personalized, premium and interesting experiences to young customers – who will soon take the main proportion on the personal finance market in the next decade.

2. Benefits and potentials of FPT.AI for banks’ operational processes

According to McKinsey&Company study, the Covid-19 pandemic created a movement in transaction methods, from direct environment to digital platforms, along with increasing digital demand of customers. Grasping this trend, AI technology significantly enhances customer experiences while shortening waiting time as well as increasing personalization, or even predicting customers’ needs to provide appropriate services on appropriate channels.

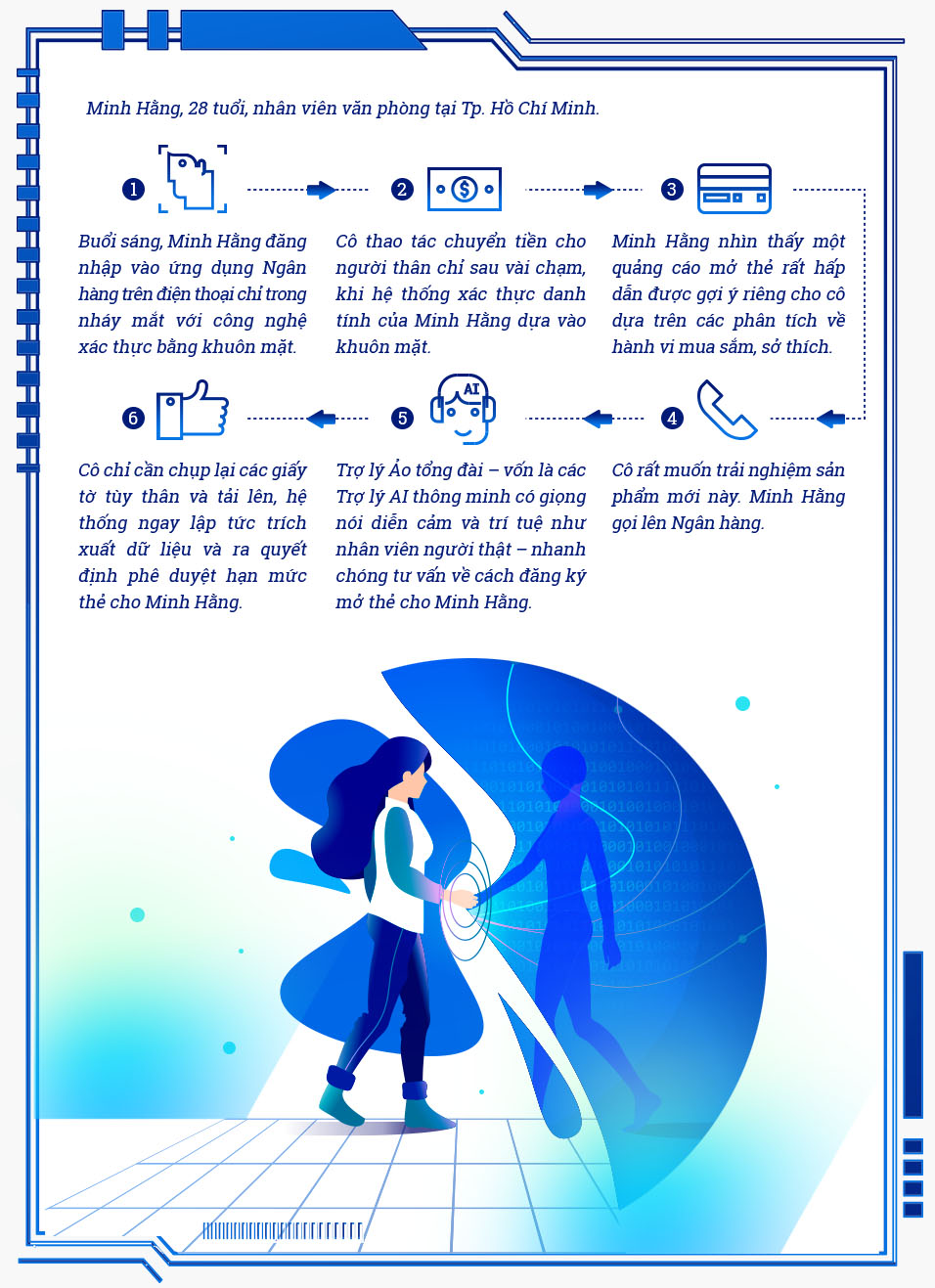

Through the chart below, let’s image a typical customer journey served by AI-powered banks to see how they can experience engaging interactions:

Through that process, Minh Hang is served quickly without any human acts. In an hour, with Virtual Assistant, banks can support millions of customers like Minh Hang at the same time. This is the strength of AI-powered banking in the digital age.

Artificial intelligence has become a powerful technology trend around the world, not only in the finance, banking industry but also in other sectors. A recent survey by PwC points out that 80% of banking experts and leaders recognize the importance and value that an AI adoption strategy can create. This technology is also expected to contribute thousands of billions of USD added value to the global banking industry – a huge number according to McKinsey’s prediction.

In particular, there are 3 benefits that AI can bring to banking, including: Breakthrough in operational performance; enhancement in customer experience; and optimization in business management. They are all main factors to create competitive advantages to banks in the new normal. In the banking market today, which organization can lead customers to state-of-the-art digital services first will win more market share and moreover can retain customers longer due to appealing technologies. With AI, banks will have a tool to achieve this objective in no time.

3. Many tech solutions are actively deployed by banks

According to the Governor of State Bank of Vietnam Nguyen Thi Hong, the unit has been researching and building legal regulations to facilitate the deployment of tech-based payment services. Organizations providing payment services, intermediary services are also studying and investing boldly in tech infrastructures, tech solutions and connecting with other services in the economy to build a digital ecosystem and provide safe, convenient payment services, enhance customer experience and satisfaction, etc.

At this time, many new, modern and cost-effective payment methods such as quick response codes – QR code, contactless payment, biometric verification, tokenization – are being applied by banks and intermediary organizations, and are integrated into their products and services to improve features, security, bring more benefits and value to customers. On mobile banking apps, e-wallets and the digital ecosystem of banks and intermediary companies, customers not only transfer money and check account balances but also perform payment for almost all of their purchases, both directly and online, such as tuition fees, hospital fees, online shopping, ride-hailing, delivery, booking flight tickets, travel tours, train tickets, etc.

That huge ecosystem requires a huge workload at the back-end to manage the system. To handle this, banks need AI power to process data, digitize documents, manage risks and support in decision making. They are all crucial steps in baking operations, in which artificial intelligence is increasingly important.

On the market, from small to large banks, from state to private or foreign banks, all have a roadmap to adopt AI in their operational processes, to be mentioned TPBank with multichannel customer service chatbot; SeABank develops Virtual Assistant voicebot integrated into call center; VPBank uses face recognition technology, eKYC for VPBankNEO; or MBBank uses OCR to digitize documents; etc.

According to a study in Business Insider, 80% of banks clearly recognize potential benefits of AI and machine learning. Another survey by Deloitte shows that 86% of businesses in the finance sector adopting AI consider AI as very important or extremely important for their success in the next two years.

FPT.AI as a pioneer in providing AI-based solutions has built AI-integrated systems for more than 80 large businesses, including leading banks such as TPbank, SeABank, and large financial companies like Home Credit and FECredit, etc. Smart call center systems with FPT.AI Virtual Agent for Call Center have been serving millions of end-users each year, handly successfully over 90% of customers’ queries.

In fact, when being implemented, FPT.AI Virtual Agent for Call Center can handle many tasks from simple to complex ones, with the ability to understand and interact deeply, bringing satisfaction to customers. The Virtual Agent can process 80-90% of requests, helping businesses to save time and resources.

The application of eKYC, OCR technology, in particular FPT.AI Reader, will help banking employees to reduce most of their boring, repetitive tasks every day, support in extracting and systematizing data with high accuracy, speed and minimize human mistakes.

In PwC’s report, enhancing customer experience will help banks gain strong advantages in digital transformation. This requires banks to use technology to serve customers, including chatbots, virtual agents to support customers automatically. Banks that adopt technology comprehensively, have the most convenient, fast, effective and safest services will gain the most customers experiencing their ecosystems. Commercial banks with wisdom and strategic vision leveraging the power of AI will have winning advantages and attract a large number of customers in the future.

Find out more about FPT.AI’s solutions at: https://fptsmartcloud.vn/yFeFO

Original article: http://nhipsongkinhte.toquoc.vn/cong-nghe-ai-chia-khoa-giup-ngan-hang-but-pha-trong-ky-nguyen-so-420212712111636772.htm